Real estate is a strategic industry in the Italian economy and played a crucial role in the economic recovery post-COVID-19. In 2022, the volume of real estate investments in Italy touched 12 billion euros, + 20% compared to 2021. After 2019, this was the highest volume ever recorded.

The constant improvement of macroeconomic indicators and the significant amount of liquidity boosted by low-interest rates are the main factors contributing to the Italian real estate market's current growth.

Foreign investors account for 75% of the transactions and continue consolidating their presence in the Italian market. Foreign capital comes from Europe for 61% but US private equity companies and Middle Eastern funds also play a relevant role.

MIPIM, the world’s leading real estate market event

Also this year, the Foreign Investments Attraction Department will join the International Market for Real Estate Professionals (MIPIM). The Italian Trade Agency will have its own Pavilion together with a collective of several Italian Institutions and Regions.

On March 13th, an Italian Conference will be held at the Italian Pavilion to promote Italian real estate trends and opportunities and to present a wide range of public and private projects.

Find out more about the real estate investment offer here: MIPIM 2024

Italian Real Estate asset classes

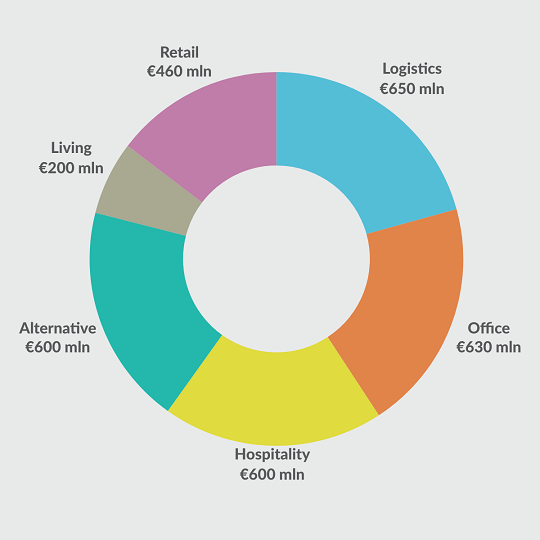

The Logistics sector confirms its leadership in real estate investments in Italy, with a total volume in 2023 of over 1.6 billion euros. In the fourth quarter, operations amount to approximately 650 million euros, contributing to position the sector as the main asset class with a 27% share of the total.

During the last quarter, Offices have shown investment levels in line with previous years, with approximately 630 million euros in Q4

Q4 2023 proved to be a particularly active quarter for the Hospitality sector, with almost 600 million euros in investments, making it the best quarter for this asset class in the past two years. 2023 thus ends with a strong recovery as the total volume reaches about 1.1 billion euros, emerging as one of the asset classes with less contraction compared to 2022.

For the Retail sector, Q4 also represented the best quarter in the last two years, with about 460 million euros invested, allowing the asset class to reach an annual volume of almost 700 million euros, mainly due to a mix of out-of-town portfolios and the return of significant transactions in the shopping centres.

Living, with investments of almost 200 million euros in Q4, of which nearly 90% concentrated in Milan, and a total of 730 million euros throughout the year, continues to increase its weight within the Italian landscape (12% of invested volumes).

In Q4, the Alternative sector attracted a volume of investments amounting to 60 million euros, still reaching an almost 900 million euros total in 2023. Particularly, the Healthcare segment showed an investment growth (approximately 600 million euros), more than doubling the 2022 result and significantly increasing its weight within the Italian market, from 2% to 10% of the total invested capital.

(source: DILS, Real Estate Market 2023 in Italy)

For more information about the Italian Real Estate offer, visit our dedicated website

Our real estate portal features two, distinct categories of investment opportunities:

-

Assets with an existing restructuring plan (such as historic buildings suitable to be transformed into prestigious offices or luxury hospitality facilities, resorts and hotels)

-

Real estate development operations (i.e. properties to be transformed or bare-ownership - whose valorisation can be directed towards the most valuable and sustainable solutions).