- About us

- Company details

ETC “Export Trading Cooperation” (www.etcgroup.it) is a italian multinational group with mixed shareholding, rated on European Securities and Markets Authority (ESMA), member of Society for Worldwide Interbank Financial Telecommunication (SWIFT), active in the financial industry to support international trade (import/export) and investment projects in Africa, with a particular focus on sub-Saharan Africa.

The activity of the holding company ETC Invest S.p.A. is "technical and financial management of international trade and investments".

ETC is associated to UNIAFRICA (www.uniafrica.org) (Italian Union for the Development of Italian African Relations), a Non Profit Organisation established to develop the economic relationship between Italy and African Countries and to support growing of African SMEs with the contribution of Italian entrepreneurship as a system of excellence.

The group ETC operates in several macro-regions in sub-Saharan Africa, with a focus on West and Central Africa, in the 17 countries that have adopted OHADA harmonized law. ETC is also present in other countries on the continent, extending to East Africa through its network of local partners.

Year of establishment:

2016

Number of employees:

FROM 3 TO 9 EMPLOYEES

Annual turnover:

between 0.5 and 2.5 million Euro

Reference year of turnover:

2018

Export turnover:

Not available

Activities:

Other financial service activities, except insurance and pension funding

Business and other management consultancy activities

Business and other management consultancy activities nec

- Contact Information

- Business Proposals

Company:

ETC INVEST S.P.A.

Web site:

Address:

VIA GALILEO GALILEI 2

City:

TREVISO SILEA (TV)

Zip Code:

31057

E-commerce:

Social media:

Tag:

No business proposals uploaded

- Map

INVESTMENT AREA (Payment Instruments & Guarantees)

Providing Letter of Credit (L/C) and Stand-by letters of Credit (SBLC) in favour of Banks and Financial Institutions to support Investment Projects in Africa, including:

- Pre-feasibility and Engineering Validation, as well as an Economic and Financial Evaluation of Investment Projects;

- Project Risk and Mitigants Analysis;

- Structuring and Management of Surety Bonds (Bid Bonds, Advanced Payment Bonds, Performance Bonds, Maintenance Bonds, Stand by letter of Credit).

Web site

https://www.etcgroup.it

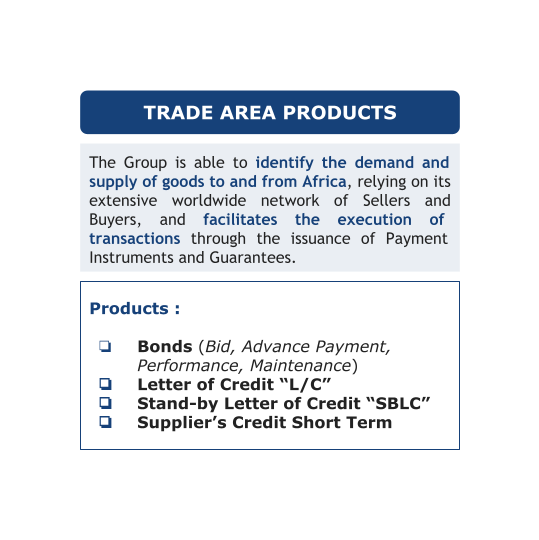

TRADE AREA (Business Matchmaking, Trade & Project Finance)

Identifying the demand and supply of goods to and from Africa, relying on its extensive worldwide network of Sellers and Buyers, and facilitates the execution of transactions providing Letter of Credit (L/C) and Stand-by letters of Credit (SBLC) in favour of Banks and Financial Institutions. Other activities include:

- Scouting and Business Matchmaking;

- Reliability Assessment of worldwide Buyers and Sellers;

- SWIFT messaging exchange between European and African issuing/confirming banks;

- Supporting all the Import/Export activities.

Web site

https://www.etcgroup.it

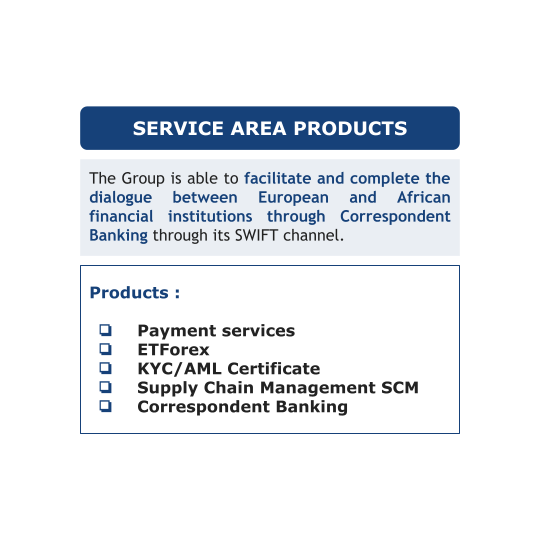

SERVICE AREA (Payment services, Correspondent Banking, Credit Recovery)

Facilitating the dialogue between European and African financial institutions through Correspondent Banking service through its SWIFT channel. Other Services include:

- Currency exchange services (ET FOREX) from local currencies to strong currencies (USD - EUR);

- Counterparty verification activities (banking or corporate): KYC & Compliance, Anti Money Laundering (AML), Anti Bribery & Corruption (ABC), Counter Terrorism Financing (CTF);

- Credit Recovery Services (in African OHADA countries) and Business Intelligence Analysis, as well as consulting activities on turnkey projects in Africa.

Web site

https://www.etcgroup.it